Introduction

Extending the business on a global level has its own attractions as well as challenges. However, it is a difficult proposition to achieve a completely global presence in all the markets with an identical core value. The decision of an organization to take its brand globally stems from the availability of many strategic opportunities like size and magnitude of the market, displacement of potential competitors, and possible economies of scale, enlargement of revenue and margins and chances of enhancing innovations. It must be remembered that each of these strategic opportunities has significant implications on the brand of a particular product that such implications are to be given full attention before setting out to explore newer markets. Failure to consider the brand implications may lead to the utter failure of the marketing efforts in the alien soils. Market culture, buyer behavior, current brand loyalties and many other considerations weigh before any product is being offered on a global level. This is particularly true in the case of electronic products where there is the need for establishing a powerful brand image that sustains the sales growth of the product under varied market conditions.

The manufacturers of electronic products have to strive hard to establish a strong brand name in the minds of the consumers. Global branding is governed by many fundamental principles like brand recognition, consistency in different forms of identity, emotional dimensions, uniqueness of brands, adaptability to the local market preferences and expectations and effective brand management. Global brands engage a number of strategic planning moves in the process of reaching their brand positioning, and the objective of this paper is to examine the strategies that Haier Group adopted to establish its market presence in Europe. In the present day, competitive business environment, it is imperative that any firm evolves a strong brand to be successful. It is also equally important that the firm build customer loyalty around its brands to sustain the competitive advantage gained by it.

Without establishing a strong brand power, the firm may not be able to acquire a significant market share. Especially in the consumer electronic market, successful brands like Sony, Philips, Samsung, LG and others compete fiercely to acquire their market share. The price, quality and innovative capabilities are the guiding factors to ensure the relative market strength of any brand. In order to get into the minds of the consumers, companies adopt different marketing strategies to promote their brands. In order to promote brand loyalty and to sustain it the firms have to undertake a continuous assessment of the strengths and weaknesses of the brand position in the minds of the consumers. Therefore, the study relating to the creation and sustenance of brand loyalty assumes a greater significance. Especially in the consumer-electronics industry where there is stiff competition among the major global brands, the assessment of the strength of a brand is critically important for its success. From this perspective, the study of the firms’ ability to build and maintain a powerful brand is expected to provide the necessary insight into assessing the marketing strategies of different global consumer electronic brands and their efforts in the creation of strong brand loyalty.

Background of White Goods Industry

Several distinguishing features characterize the household appliances industry (e.g. Nichols and Cam 2005, Paba 1986, Perona et al. 2001). The foremost among them is the constant demand for innovation. Consumer electronic appliances are the result of the application of core technology in modern society. Apart from their importance in computing, telecommunication and consumer-based items, they have proliferated to serve household needs largely. For instance, microprocessor technologies have been found to assist in medical and genetic engineering areas. High-end electronic technologies are used in the sphere of washing machines and other appliances. In order to meet these varied demands, the household appliances industry is expected to meet a constant demand for newer products to keep pace with the changing customer needs (Sobrero and Roberts 2002). Significant growth in the household appliances industry can be traced to the rapid technological advances made by the industry.

The manufacturing processes of household appliances are constantly renewed for advancement due to a competitive necessity. However, the greater competitive demand for innovation makes the household appliance products obsolete in a faster pace. Because of this, the manufacturers are compelled to make continuous changes in the product lines so that they can keep pace with the emerging competition in the global market.

Changes in the manufacturing process are also necessitated to have control over costs, for maintaining the quality of the products and to meet the corporate pollution prevention objectives (SOR, 2005). Due to the complex competitive dynamics of the electronic appliances industry, only companies that are capable of bringing about rapid changes will be able to sustain and/or capture the market share. Many of the products sold by the appliances industry have only shorter useful lives. This is mainly due to the constant changes in the consumer demand for enhanced performance and miniaturizing desires. Examples of this phenomenon can be seen in the increased demand for thinner innovative designs and additional features that increase the convenience of the consumers.

The technological dynamics of the household appliances industry distinguish the industry from other traditional manufacturing sectors. Continued demand for innovative products drives the household appliances industry to evolve changes in the manufacturing processes that provide for reduced production cycle time, increased productivity and reduced unit cost of production.

However, the shorter product cycles cannot be achieved in a relatively shorter duration and it does not necessarily imply that the appliances industry would be able to adapt to the required changes in easy and quick steps. Since the processes involved in the manufacture of electronic appliances and gadgets are complex and interdependent, it takes more than normal time to achieve the required technological development. Within the industry, there will be several significant hurdles to hinder the development process and these must be overcome to implement any technological upgrades or innovations into the production process. Most of these developments call for extending fundamental research processes in many of areas. Therefore, some changes may take several years before they come to the implementation stage.

“Consumer electronics companies producing computers, televisions, DVD players and other household electronics face the same challenges as other consumer goods companies,” (Morva). The product life cycle in the household appliances industry has been facing a shrinking trend due to severe price deflation. The continued price deflation makes a demand, pricing and promotional management of household appliance products even more challenging. Factors like innovative ability, differentiation of the products and flexible nature of the organization have been considered critical ones for the continuance of the household appliances industry. However, consumer demand has been showing a growing trend due to falling prices and improved functionality aided by the convergence of technology and they influence the consumer demand largely.

The dynamism with which the industry is operating is very high because of heavy investment in research and development activities by the firms operating in the industry. Through these research and development activities, firms are able to manufacture and market new and improved models of household appliance products, which compete with each other to attract customers with their advanced features and product excellence.

In order to succeed in the competitive environment, it is critically important that the manufacturers employ leading-edge material and process technologies to meet the continuously demanded performance enhancements. With the emphasis on the performance of the household appliance industry, the manufacturers should ensure that their products exhibit superior performance levels, or else there is always the risk of losing the business to the competitors. Despite the effective performance capabilities, the success of household appliance products depends largely on the ability of the firms to create a brand name and nurture consumer loyalty around the brand.

“At the corporate level, the world home appliances industry is still rather fragmented with no single manufacturer commanding more than 10 percent of the world market. Fragmentation reflects the high incidence of transport costs, persistent differences in consumers’ preferences and brand loyalty” (Bongalia &Goldstein, 2007). This feature affects the internationalization and marketing strategies of electronic manufacturers.

Aims and Objectives

Analyzing the marketing and internationalization strategies of Haier Group to enter the European market is the central aim of this research. In the process of meeting this central aim, this study attempts to accomplish the following other objectives.

- To study the marketing and internalization strategies of household appliance brands in general

- To study the concept of branding and its impact on internationalizing household appliance products

- To analyze the impact of different factors influencing the expansion of household appliance products on a global level

Research Questions

Based on the primary data collected through a questionnaire survey and secondary information collected, this study will find the answers to the following research questions.

- What are the significant elements in the brand management of the household appliance brands in maintaining their brand equity?

- What are the key issues that need to be addressed by household appliance brands to expand their brands internationally?

- What are the marketing strategies adopted by the household appliance brands like Haier to achieve their global expansion?

- What are the ways in which the household appliance brands meet the key challenges in internationalizing their brands effectively?

Rationale

In the present day competitive business environment, it is imperative that any company to be successful and sustain its growth has to evolve a strong brand and build brand loyalty around its products. The development of such branding is also important for the global expansion of the product. This requires a continuous assessment of the strengths and weaknesses of the brand’s position in the minds of the consumers. Therefore, the study of the success of a brand assumes a greater significance. Especially in the consumer, electronics industry where there is stiff competition among the major global brands the assessment of the strength of a brand is critically important for internationalizing its products. From this point of view, the assessment of brand loyalty and the ability of the consumer electronics products to build and maintain a powerful brand will provide the necessary guidance to the other brands to change their strategies so that they also compete effectively in the global market arena. In this context, this study on the marketing and internalization strategies of consumer electronics major Haier Group adds to the existing knowledge on consumer brand loyalty with respect to consumer electronics products.

Structure of the Dissertation

For presenting a cohesive research report, this paper is organized to have different chapters. The first chapter while introducing the research topic of internationalization and marketing strategies lays down the aims and objectives of the research and it also outlines the research questions. Chapter Two presents an analytical review of the relevant studies on international marketing strategies with the objective of extending the knowledge on marketing and internationalization strategies of consumer electronic goods. While Chapter Three provides a brief description of the research methodology, Chapter Four presents the findings of the research and an analysis of the findings. Chapter Five concludes the dissertation with a summary of the findings and recommendations for deriving maximum benefits from internationalizing the consumer electronic product.

Literature Review

Wide range of economic liberalization and advanced information and communication technology has opened up the international markets and this has increased the levels of competition among firms. Globalization has kindled the desire in large and medium-sized firms to increase their values by expanding their presence in different geographical locations. Apart from the generic strategies of product differentiation and cost leadership, firms desirous of expanding their business to foreign markets are formulating and adopting several strategic measures to achieve the organizational goals of cost minimization and profit maximization. The strategies include localization, global standardization, and transnational and international strategies. Firms depending on the degrees of pressures of local responsiveness and cost reduction resort to the adoption of any of these strategies. Experience curves and location economies help the firms to reduce production costs and enhance profitability. Core competencies and leveraging of products also enable the firms to improve their profitability.

Outward foreign direct investments enable both small and large multinational enterprises, to enhance their competitive strength by securing access to international markets, up-to-date technologies, branding, additional resources and strategic assets located in foreign countries. In their constant endeavor for better exploitation of different markets, firms pursue a variety of marketing and related strategies, which include product and technological diversification undertaken in different geographical locations (Cantwell and Piscitello 1999). Firms, which have decided to focus on the domestic market, may not be able to derive the benefits of these factors enhancing their competitiveness of firms. Moreover, firms that concentrate on developing within the domestic market are most likely to miss out on opportunities that are available to firms expanding to global markets. These opportunities include the chances of becoming integrated into global value chains or attracting global customers, which increase their business (Lee, 2001).

During the last two decades, there has been a rapid growth in the number of firms from developing economies like Brazil, China, India and Korea expanding into different geographical locations and these firms are considered as part of a “second wave” of developing countries multinational firms (Wells 1983; Lall 1983). These “second-wave MNEs appear to be driven directly by firm-to firm contracting in a global setting – frequently involving SMEs initially being drawn into the global business domain through contractual linkages with larger MNEs.” The internationalization of these organizations may be said to be the direct and significant outcome of globalization. The purpose of this review is to analyze the relevant literature on the different strategies adopted by these multinational organizations for expanding their operations into foreign countries.

Growth of Multinational Operations

The existing literature provides a strong basis for understanding the motives behind this increasing tendency of businesses to expand their activities across new markets. Early research has contributed to the development of internationalization theory at the micro-economic level; for example, Hymer (1976) focused his revolutionary study on market barriers to entry as well as competitive advantage gained in foreign markets through firm size, economies of scale and marketing skills. Moreover, Vernon (1966) provided a strong model of the product life cycle (PLC) that illustrated why and how US companies go global in different stages of their products. Both Heymer’s and Vernon’s theories are based on the market imperfection paradigm. Graham (1975), with the exchange-of-threat model, explained how firms react to the actions of their competitors by expanding abroad.

Finally, Dunning’s eclectic model (2002) harmonizes these different theoretical approaches into theories of organization, trade and location with models of ownership-specific advantages, location advantages, and internalization advantages. The eclectic model is grounded primarily in the market failure paradigm that focuses on market complications resulting from bounded rationality and opportunistic behavior (Teece, 1981 and Terpstra & Olsen 1993). This theory assumes that the firm is better off by internalizing its activities when the cost of market transactions becomes excessive — i.e. when the domestic market fails. Once these factors motivate a firm to expand its operations to the new emerging markets, the company must decide on the strategies that it could adopt to compete most effectively in the selected foreign markets. Some of these strategies include adopting innovative technology in product design, implementing brand strategy, strengthening brand consciousness and improving the quality of the products.

Internationalization of Emergent Multinational Enterprises (MNEs)

Almost all consumer product manufacturers of developed countries has shifted some or majority of their manufacturing operations to developing countries (Feenstra 1998; Gereffi and Sturgeon 2004). Lead firms involved in sectors like consumer electronic manufacturing focus on the creation, penetration and defense of markets for products, by shifting the manufacturing capacity to globally operating turnkey operations (Sturgeon, 2002).

“As Brazil, China, India, Mexico or Turkey are emerging as industrial powers in their own right, the best of their consumer-goods producers are making the transition from “original equipment manufacturers” (OEMs) selling their own standardized commodities with a foreign firm’s brand affixed, to original design manufacturers (ODMs), and a much smaller number have further progressed into original brand manufacturers (OEMs)” (Goldstein et al., 2006).

For example, suppliers in clothing, electronics and automobile manufacturers have opted to create ODM capacities; however, some of the selected electronic manufacturers have opted to become OEMs. Theoretically, there are two characteristics presented for analyzing the internationalization of firms (Mathews, 2002; 2006). Firstly, all these firms expanded to different countries at a fast pace, which makes “accelerated internationalization”, a peculiar character. “Secondly, they have been able to achieve this accelerated internationalization not through technological innovation, but through organizational innovations that are well adapted to the circumstances of the emergent global economy” (Mathews, 2000). Firms have been able to adopt these approaches by evolving strategic innovations, which helped them to exploit the advantages available to latecomers.

In this process of internationalization, unlike the early movers, the latecomers and newcomers have adopted a variety of global organizational forms, dispensing with the traditional “international division” concept of organizational structure. This step taken by the MNEs signifies that they adopt their internationalization strategy with a completely global outlook, which is different from the traditional ways of looking at internationalization. Anderson and Forsgren (1996) observe that this practice has helped the MNEs to avoid the “subsidiary-headquarter” problems, which led to several morale and initiative issues. Mathews (2006) has documented one of the many possible trajectories in creating new organizational structures to meet this new requirement of globally expanding firms. Technological innovations are one of the strategies adopted by firms for expanding into foreign markets. This chapter highlights the technological initiatives of Haier Group for its entry into international markets. Branding is another strategy used by firms desirous of expanding into global markets.

Branding

The concept of brand encompasses the creation of a name, term or symbol, sign, or design by a firm to be used to differentiate the product or service it is offering to the public from the one being offered by the competitors. (Czinkota & Ronkainen 2004) A brand is represented by the sum of its equity, identity, positioning, personality, essence, character, soul, culture and the brand image associated with the particular brand. (Upsaw 1995) According to Knox & Bickerton (2000), the concept of brand relates to product marketing. In product marketing, the creation of a brand and its management assume the responsibility of establishing differentiation and preference for a particular product or service in the minds of the consumers. Branding has been developed in the last 3 decades to perform the function of value addition to the product or service by creating differentiation for the product or service in the particular market.

Hankinson and Cowking (1993) observe that in order to develop and sustain a distinct competitive advantage superior to that of the competitors it is essential for the firm to build a strong brand so that the firm would be able to maintain its market share for the product. Rooney (1995) is of the view that branding can be considered as an effective and powerful tool available to organizations for promoting their businesses. When the brand-owners are able to exhibit the better quality of their products, then they can expect substantial payoffs. On the other hand, with mismanagement of a brand the repercussions are phenomenal and devastating. By building a powerful brand, the firms would be able to create a distinctive market position and this protects the firm against different competitive forces acting on the firm. Branding is broadly recognized as a technique, which is used to build a significant differential advantage. For achieving this branding uses the nature of human beings. Branding cannot be considered as rational in its entirety as human beings attach more meaning and feeling to inanimate things and a random collections of symbols that are contained in different brands. (O’Malley 1991). Successful brand creators go beyond the point of representing product-attribute associations and develop other factors like organization association, brand personality, symbols, emotional benefits and self-expressive benefits as additional associations with brands to make them strong and powerful (Aaker, 1998).

A ‘branding cycle’ is developed by Hankinson and Cowking (1993) which covers the creation and maintenance of a powerful brand. The branding cycle consists of research, brand proposition, marketing mix, communication triggers and the consumers.

Branding Cycle

The concept of brand management evinces great interest as the success of any brand depends on efficient management of the brand to contribute to an invaluable asset to the company. Brand management covers the process of managing a brand from the time it is introduced in the market until it is taken off there. Dalrymple and Parsons (2000) define a brand as “a name, term, sign, symbol or design intended to distinguish the goods and services of one seller from another”. Tybout and Carpenter define a brand as “a name or some symbol or mark that is associated with a product or service and to which buyers attach psychological meaning. Since a brand symbolizes the ideas and thinking of the consumers about the attributes of a product a brand is considered to have much more association with the product than just the name.

Kotler (2003) has outlined the implications of building and maintaining a brand. According to Kotler (2003) while the name, logo, color, symbol, design, etc that are the parts of the brand can be considered effective marketing tools and tactics, the brand by itself has to guarantee the delivery by the marketer of a particular set of features, benefits and services on a consistent basis to the buyer. Kotler (2003) further reiterates that it is for the marketer to ensure that the brand has a mission and the brand should have a vision explaining what position the brand wants to occupy and what it proposes to do. There are a large number of associations that can be connected to any product either singly or as a combination thereof. (Tybout & Carpenter, 2000) Therefore, marketers are in the lookout for attractive images, which characterize their products, and differentiate them from those of their competitors. This differentiation normally is dependent on tangible and intangible assets like quality, shape, and color and lifestyle compatibility. (Dalrymple & Parsons 2000)

Branding essentially has three elements in its effective creation and management. They are: (i) the first element is the ‘brand reality’ denoting the identity of the product, the ‘niche’ at which it stays and the special features that distinguish the product from others in the market, (ii) the next element is the exposure the brand reality gets by means of effective communication of the brand. Communication of product qualities is accomplished by advertising through different mediums. Public relations and training also help to improve the communication process. However, it is to be ensured that all the communication outlets convey the same message concerning the product, and (iii) the third element in the cyclic process of branding is the development of the products that take into account the perception of the public about the brand image of the product. The product development is a futuristic affair, the image is built into the product year after year, and the development is guided by the brand identity. Any change in the image can be expected only incrementally over a period of time and that too by means of effective communication.

Growth and Internalization of the Haier Group

Haier Group is the largest manufacturer of household appliances in China. Qingdao Refrigerator plant, which was near bankruptcy situation, was renamed Haier Group in 1992. In this year, the appointment of Zhang Rimini, as the plant director (who is currently the CEO) of Haier contributed to the turnaround of the company (Liu and Li 2002). While the company produced only refrigerators originally, it manufactures and distributes a wide range of household appliances throughout the world, with 15,100 products spread over 96 product lines. “In 2004, Haier was recognized as one of the World’s 100 Most Recognizable Brands in a global name brand list edited by the World Brand Laboratory” (Duysters et al 2009). In 2008, Haier stood at the 13th position on Forbes’ Reputation Institute Global 200 list. “These figures and rankings indicate that over a period of two decades, Haier has grown from being a small, almost bankrupt enterprise to being one of the leading household appliances makers in the world.”

Early Years of Quality Improvements

Globalization, which changed the direction of several world economies, helped the progress of Haier greatly. Haier took its first step towards technological development in 1984. In this year, Haier imported a new refrigerator manufacturing technology from abroad. “After a careful evaluation of 32 potential cooperative partners, Haier decided to establish an alliance with the Liebherr Company of Germany,” (Duysters et al. 2008). With this alliance in place, Haier was able to import Liebherr’s “four-star refrigerator production technology” and the related equipment into China. “Liebherr had 70 years of experience in producing high-quality refrigerators” (Duysters et al. 2008). The company had the reputation of making one of the leading appliances in the world. With the acquisition of four-star refrigerator technology, Haier took the position of the only manufacturer in China who was able to distribute this modern refrigerator in the country.

“Haier followed up the licensing of Liebherr’s four-star technology with an active learning and R&D strategy” (Duysters,et al. 2009). Haier established a sophisticated R&D department. The Company trained 40 of its professionals and managers at the works of Liebherr in Germany. Liebherr contributed to the technological development of Haier by enabling Haier staff to master the key technical skills required for developing technologically improved refrigerators. “In 1985, a year after it licensed Liebherr’s technology, Haier was ables to introduce its first four-star refrigerator in the Chinese market” (Duysters, 2008). “This product instantly established Haier as the leading refrigerator producer in China” (Duysters, 2009).

New Focus on Quality

With the increased competition because of globalization, Haier had to focus on quality improvements to sustain its domestic market position. The company realized that it could no longer concentrate only on cost considerations, but must focus on quality improvements. In addition, the company made strategic planning to move into foreign markets. In order to achieve the goal of becoming a globally leading enterprise, the company decided to set higher quality standards than the Japanese manufacturers, which at that time was considered the best in the world. The company launched a quality drive to achieve an all round improvements in “quality, service, design and technological capabilities.” According to Japanese standards, the return-repaired ratio of refrigerators must be less than 0.6%. Haier set even a higher international standard of 0.4%. Haier received “China’s National Quality Gold Medal”, a prestigious award in the year 1988 for its quality achievements in the refrigerator industry. “In 1990, Haier’s refrigerators passed the American UL certification. Since then, Haier successively passed, among others, ISO9001 certification, ISO14001 environment system certification, the European CE certification, the Canadian CSA certification, the German VED and GS certification, the Japanese S certification, and the Australian SAA certification.” With the ability to meet all these international quality standards, Haier launched its products in to the European market.

The company adopted the scientific management principles of F. W. Taylor and the “Total Quality Management” (TQM) approach of Japanese. “Haier made extensive use of the technological and managerial learning from its technology cooperation with Liebherr” Duysters, 2008). Even after reaching the pthe position of industry leader in the refrigeration industry, the company continued its efforts to improve its technological excellence. This enabled Haier to enter other international markets by entering into technological alliances.

Growth Strategies

Haier was able to achieve its objective of becoming the world leader in household appliances, by combining the strategies of internationalization of technology on the one hand and product diversification on the other hand.

The company could embark on a rapid expansion of its product range. It also increased the number of its technology alliance partners over time. From a single technology alliance partner of Liebherr, the company could associate itself with a number of other enterprises worldwide. This is evident from the above table, showing the contribution of foreign partnerships to the growth of Haier Group.

It was a technology alliance, which enabled Haier to be successful in its diversification strategy. “From then on, Haier started to diversify into new product markets ranging from freezers to air-conditioners” (Duysters, 2008).

Subsequently, Haier entered into the development of washers, microwave ovens and water heaters among others. The following figure illustrates the diversification of Haier’s technological competence-base. The above figure evidences the rapid product diversification of Haier based on the number of patent applications made by manufacturers in different fields to the Chinese government.

From the figure, it may be observed that Haier focused more on the manufacture of refrigerators and washing machines, and other patents applied by the company represent the remaining products developed by the company.

With the development in its technological capabilities, by the year 1996 Haier started exporting its technologies in addition to its products. The company made several strategic alliances by using its improved technological capability and product diversification. This enabled Haier to enter several overseas markets extensively. Since 1990, Haier launched its products in global markets spread over Europe, North America and a host of other industrially advanced countries. Along with its growth in exports of products and technology, Haier worked on the establishment of a “global network of design, manufacture, distribution and after-sales services.

“Leveraging its technological base and product range, Haier has entered into cooperative research programs with leading foreign companies” (Duysters, 2008). Some of the company’s technological cooperative partners are Toshiba, Mitsubishi, ESS, Philips, Metz and Lucent. The technological alliances entered into by Haier provided the company with date information on the development of global trends in technology development and such knowledge was the backbone of its technological excellence. Because of its close association with the world technology leaders, Haier was able to use its “radar function’ for scanning and evaluating new and emerging technological developments around the world. Haier has established close to 15 overseas design and R&D centers, responsible for developing a new range of household appliances, which meet the customer preferences in different parts of the world.

Over the period, Haier has created three industrial parks in the countries of the United States, Pakistan and Jordan. There are 30 manufacturing centers established in different parts of the world. There are 58,800 sales agents working for promoting the sales of the company, throughout the world. Haier has customers in more than 160 countries in Europe, North America, the Middle East and Asia.

“Some of Haier’s overseas acquisitions are significant from the point of view of generating knowledge spillovers. For example, in June 2002 Haier purchased a refrigerator factory in Italy, making Haier the first Chinese enterprise to purchase a factory in the European household appliance sector. The factory is located in a geographic area that has a concentration of many top home-appliances makers, such as Whirlpool, Candy and Zanussi” (Duysters et al., 2008).

As pointed out by Beaudry (2001), close geographic proximity with incumbent firms leads to the creation of “localized knowledge spillovers”. “This is in addition to the traditional benefits associated with industrial clusters: labor market pooling and input sharing” Duysters, 2008).

Haier follows a globalization strategy of “three one-third principles”. “Under this, one-third of its products are both produced and sold in its home country, one-third of the products are produced in the home country but sold overseas, and one-third of the products are both produced and sold overseas.” For planning and executing its global expansion plans, Haier follows the approach of “from difficulty to ease.” Under the approach, Haier will adopt the strategy of entering those markets, which are tough at the first instance, before the company moves into those markets, which it can tackle easily. According to the belief of the company, when the company enters an advanced market first, it would be able to gain greater brand recognition. In the marketing realm, gaining brand image is an essential precondition for penetrating into the market for expensive products. For example, Germany, which is the toughest market in the Europe, is the first one, which Haier entered. The company is also keen in targeting niche markets both within and outside China.

“In the US, for example, Haier developed a refrigerator model with a fold-out table aimed at students; this was after product designers who visited cramped dormitory rooms discovered that students put boards across two refrigerators to create a makeshift desk. Likewise, in China, Haier developed a washing machine model that serves the dual purpose of washing clothes and washing vegetables. This model, targeting rural areas, was the result of Haier repairmen reporting back to the company that people in rural China use their washing machines for cleaning vegetables as well” (FT, Sept, 24, 2004).

The German market is regarded generally as the toughest markets to penetrate in the EU. Haier was able to establish its presence in this market by its sheer technological excellence. The company has also entered other markets in Asia, such as Indonesia, Philippines, and Malaysia. Haier has established joint ventures in the United Arab Emirates for capturing market share in this country. Sixty percent of Haier’s business comprises of exports to European and North American markets.

Research and Development (R&D) Initiatives

The diversification efforts of Haier are supported by suitable adjustments made by the company in its R&D initiatives.” Haier repeatedly adjusted its R&D organizational structure and increased its R&D spending so that its new products could be brought to the market quicker” (Duysters et al. 2009). The company has gradually increased the proportion of its R&D expenditure to total sales from 3% in 1997 to 6% in 2005. In the year 2006, Haier has spent more than 70% of its R&D budget in overseas R&D centers (SCCBD, 2007).

The above table provides a comparative status of the R&D expenses of Haier with Sony and GE. From the table, it can be observed that R&D spending by Haier is nearing the proportion of spending by Sony and it is already greater than that of GE.

Haier is focusing on marketing “mainstream” high-end products because the company enjoys a higher profit margin. The company has to concentrate on selling of high-margin items, as from the year 1990; the profit margin of the company is declining because of severe competition from other manufacturers in China. For instance, the profit margin of Qingdao Hair Co., one of the subsidiary companies of Haier making and selling home appliances reduced from 10.4% to 2.2% between the years 1994 and 2007. On the other hand, reputed large MNEs such as General Electric continued to earn a profit margin of 10-13% over the last few years.

Since the start of its diversification efforts in 1991, the R&D lab, which was previously called as “Refrigerator Institute,” was split into three different entities – the refrigerator group, the freezer group and the air-conditioner group. In the year 1995, Haier established a new research center dealing only with technological developments. “The center consisted of three main administrative levels. The first level was the corporate group, which was responsible for the development of core technologies and basic research. The second level was created in every department (business unit). The third one was connected to every plant (cost center)” (Duysters et al., 2008).

Research Methodology

The objective of this chapter is to describe the methodology adopted for meeting the aims and objectives of this study. “In the discussion of the selection of a problem suggests valuable criteria: (1) novelty of the problem, (2) investigator’s interest in the problem, (3) practical value of the research to the investigator, (4) worker’s special qualification, (5) availability of the data, (6) cost of investigation, and (7) time required for the investigation,”(Watkins (1994) quoted by Reyes, (2004); Burn and Grove, (2005). While considering all these aspects one of the most important issues in conducting social research is to find a way of getting the focus on the different aspects like the problem statement, conceptualizing the theory and choosing the research design. “Focus provides the integration of seeming diversity of the elements of the process from the presentation of the problem to the scope of research, conceptual framework, related literature, instrumentation, appropriate statistical methods to be used as well as the design and methodology used,” (Reyes, 2004, p 3).

Denzin and Lincoln (1998) state the researcher is independent to engage any research approach, so long as the method engaged enables him to complete the research and achieve its objectives. However, it is essential that the researcher consider the nature of the research inquiry and the variables that have an impact on the research process. The researcher has to evaluate the appropriateness of the methodology as to its ability to find plausible answers to the research questions within the broad context of the nature and scope of the research issue. For the current research on assessing the marketing and internationalization strategies of Haier Group, considering the research issue under study, the quantitative approach is adopted. This chapter presents a description of the research method and discusses the salience, merits and demerits of the method adopted. The justification of the research method also forms part of the chapter.

Research Design

The research design encompasses different elements involved in the research methodology, in which the process specifies the limits of the research. These boundaries take the form of the research philosophy and approach. The research strategy including the research techniques and data collection methods also are components of the research process. Within the boundaries of the research process, the time spheres for completing the study are also included.

The format for further investigation can be decided by defining the research problem clearly. When the research problem is well defined, it will automatically point towards the appropriate method of investigation. However, there can be no single research method that can be used for all research issues. There are a number of research techniques, which are available to the choice of the researcher. Often the researcher has to make many trade-offs, in the process of selecting of a suitable research technique. For example, the researcher has to compromise in the quality of information, if he has to consider the cost of data collection and analysis. In some other cases, time constraint may be the prominent force driving the researcher to choose a particular research technique. Therefore, the design of a research process is always influenced by both budget and time factors in arriving at the research technique. The research design may be categorized into descriptive or causal. The purpose of causal studies is to find the effect of one variable on another.

Generally, social researches are carried out using several research approaches with the objective of increasing the existing knowledge in the areas in which such researches are undertaken. The other objective of the research is to enhance the theoretical contribution to the subject matter. There are several research techniques, which are associated with the epistemological structure. The research techniques can be grouped under five categories. The techniques cover experimental studies, correlational methods, and natural observations of respondents’ behaviors, quantitative surveys and qualitative case studies. The process of any research study in the field of social sciences has to follow an appropriate research design to achieve the research aims. The selection of a specific research design relies on the subject matter of research and the scope and nature of the inquiry. Even though the research techniques are grouped under different heads, popularly used techniques are qualitative and quantitative approaches.

Research Philosophy

This study proposes to adopt a positivist epistemological approach. This philosophical approach explains the means of gaining the needed understanding for carrying out the study. Generally, social research is carried out using the facts drawn from the data and analyzing the facts to arrive at definitive findings from the study. Providing the foundation of understanding needed for creating the framework is the main area of concentration of epistemological positivism (Remenyi, Williams, Money, and Swartz, 1998). Moreover, in positivist research, the concept of deductive reasoning is applied for extracting the existing common themes, which could enable to prediction of the most common human perceptions and reactions (Cavana et al., 2001). Orlikowski and Baroudi (1991) have found that more than 90 percent of the social research in the United States is carried out using a positivist approach. Ridley and Keen (1998) state more than 85% of the research studies carried out in Australia also employ positivist epistemology as the underlying philosophical approach. This evidences the fact that the proposed research engages one of the most popular philosophical approaches used at the international level.

Quantitative Research Method

On the question of the use of the qualitative and quantitative methods, the merits and demerits of both methods are considered. Qualitative research is subject to criticism, that the researcher can arrive at the research strategies after he starts with the process of data collection. This is because the researcher has to adhere to the systematic follow up and appreciate the meanings of the facts and data in respect of the background in which they are collected. Under the qualitative method, it becomes essential that the researcher spell out the primary issues to be examined in advance and subsequently to proceed to formulate the strategies for collecting the required data. Since in the current study it is not possible to decide on the primary issues before the research is commenced, it is proposed to use the quantitative method.

The quantitative research method is based on the consideration of numeric values involved in the research inquiry. The quantitative method generally uses statistical analysis of the findings of the research to accomplish the objectives. Collection and analysis of empirical data form the basis of the quantitative method. Various research instruments such as survey questionnaire is used for gathering primary data under the quantitative research method. Burns & Grove (1993) observe that quantitative research is a methodical process, which quantitative data for gathering the facts on the research issue. The researcher can approach his work with comfort, as the quantitative method is both objective and reliable. This makes the quantitative method as a favorable research method. Irrespective of the researcher, the quantitative method will lead to the same findings from the study. Under the quantitative research method, the researcher has the option to present the findings of the study in the form of quantifiable and reliable data, which is a unique strength of this method (Trochim, 2001). In view of the distinct advantages of the quantitative method, this study proposes to use a quantitative survey to achieve the research objectives.

Research Approach

A social research uses either a deductive or inductive approach for proceeding with the research. Saunders et al. (2009) identify the goal of the inductive approach is to get a better understanding of the meaning attached by human beings to events. The inductive approach also provides an in-depth knowledge of the research context. Inductive approach also comprises of the process of data collection for a qualitative study. The major concern about inductive approach is that the approach does not possess the requirement of generalization. On the other hand, Deductive approach generally commences with forming a design of the research inquiry. In many of the qualitative studies, the researcher engages a deductive approach instead of the inductive approach.

This study uses a deductive research approach.

Primary and Secondary Approach

Any research can be conducted using data collected from two sources – primary and secondary. The primary data represents data collected for specific use employing different research tools. Secondary data is collected from existing sources, where the data is collected by someone else for a different purpose (Proctor, 2005). The current study will collect primary data based on the responses for the survey questionnaire posted to the samples.

Data Collection

Social researches using a quantitative approach use the process of data collection through surveys, construction of questionnaire and analysis of data collected through the questionnaire. The research approach also has the purpose of identification of the problem and the methods of mitigating the problem (Ghauri et al., 1995). Sources from which data are derived are called the data carriers. Data can be retrieved from either primary or secondary sources (Ghauri et al., 1995). Primary data or field data represent the facts and information gathered to meet the objectives of a specific research inquiry. The primary information may take the form of examination of variables and discussions with connected individuals. Secondary data (desk) represents data gathered by some other people for a different reason. The information may emanate from academic resources and/or non-academic resources.

Since the person doing the research is under an obligation to present a comprehensive research report on the chosen topic, the collection of Primary Data from the field is very much essential to provide the basis for the presentation of a true and fair report. Therefore, the research will be using the method of preparing and distributing questionnaires to the chosen samples for collecting the basic data necessary.

Survey Method

Survey is a non-investigational and expressive method for carrying out different studies. The persons doing the research for the gathering of facts on various subject matters are employing this method where the persons doing the research are not in a position to retrieve information on their own. Survey uses a questionnaire for gathering information. The survey method is subject to the criticism that it is planned and managed in a confused way that it leads to the collection of improper data. According to Meyer (1998), the success of the surveys depends on a vigilant choice of samples and appropriate construction of the questionnaire. An improper questionnaire would lead to the collection of worthless information. The facts gathered from the respondents to the survey symbolize the perceptions of the entire population. Therefore, it is important that the researcher uses an intelligently designed questionnaire to collect the required information (Cresswell 1994; Newmann, 2002; Fink, 1995).

The survey method is preferred over the qualitative methods of focus groups or interviews because of the large population involved and the survey method will be able to express the finding in the form of quantitative or numeric descriptions based on information retrieved from some fraction of the population representing the sample, by the use of simple questions. Surveys enable generalisation of the findings of the surveys, as there is an opportunity for a large population to take part in surveys. Moreover, interviews are more time-consuming and expensive than the survey method.

Questionnaire

Gathering primary information for the proposed research will be by distributing a questionnaire to the chosen respondents. The Questionnaire is a research instrument containing a set of questions prepared to draw information from the respondents and the responses will be subjected to analysis and interpretation for making the research report. The drafting of the questions to be included in the questionnaire was attempted by taking information and ideas from the findings of the earlier research to find out various elements that can be applied to the current research. Questionnaire is the preferred research instrument by many of the researchers to carry out researches in various spheres (Creswell, 1994). Questionnaire is the most appropriate research tool to gather methodical and meaningful data from a large population. Using the information collected in a survey the researcher can present an analytical study supported by empirical evidence (De Witte and van Muijen, 1999). The questionnaire used as the research instrument is exhibited as Appendix I.

Samples

The researcher has the obligation to specify the chosen samples clearly. Even though there are no define rules for sample selection, the person doing the research has to rely on his logical ability and judgment. Target sample population has to be defined keeping in mind the aims and goals of the research. In cases where the total number of people to be studied is less, the person doing the research may decide to include them all in the investigation. If the number of people to be studied is too large, the people doing the research can vigilantly choose the samples, to symbolize the total number of people. The samples must be selected in a way that it symbolizes the features of the total lot from which the sample was selected. Samples may be selected using probability or non-probability sampling methods. Random sampling, systematic sampling and stratified samples are some of the methods used in the selection of samples under probability sampling. In non-probability sampling, samples are selected following some nonrandom ways of selection. The advantage of probability sampling is that the researcher can detect sampling errors. Sampling error is the extent to which the selected samples may differ from the population from which the samples were drawn. In non-probability sampling, however, there is no possibility of the sampling error be detected.

Random sampling is the perfect method of drawing samples under the method of probability sampling. When the population to be selected is very large, it becomes difficult to select the samples from the available population and therefore the pool of available samples becomes biased. In the current study, the samples are selected using random sampling under probability sampling.

A quantitative questionnaire survey was conducted among 52 dealers/distributors of household appliances selected on a random sampling basis, from the Internet database of appliances dealers to collect information on their perceptions on the marketing and internationalization strategies. Questionnaires were sent to 186 small manufacturing entrepreneurs of whom, 52 of them responded to the questionnaire survey making the response rate of 27.9%. The study used the email survey method, where the questionnaires were sent through email to the participants with a request to send back the completed questionnaire by mail.

Findings

This study hypothesizes that the multinational enterprises can enhance their chances of internationalizing their products by following effective marketing and internationalization strategies. The current study analyzes the case of the Chinese appliance manufacturer Haier Group with reference to the marketing and internationalization strategies followed by the company. In this context, this chapter presents the findings from the quantitative survey conducted among 52 dealers and distributors of household appliances operating in the UK. Survey was conducted by sending the survey instrument of a questionnaire by email, for collecting primary data on their perceptions and experiences about application of marketing and internationalization strategies for promoting the sales of household appliance products in foreign markets. There were owners and managers of these distributors who constituted the respondents to the survey. Questionnaires were sent to 186 dealers/distributors of whom, 52 of them responded to the questionnaire survey making the response rate of 27.9%

Profile of Respondents

Analysis of the profiles of the respondents from the dealers of household appliances surveyed indicates that majority of the respondent organizations were owners involve in the business. The respondents represent the owners of the dealership/distributorship organizations and some of them are managing the business on behalf of the owners. Since the research followed a non-probability sampling technique, the samples do not fulfil any objectives of statistical requirements meeting the standards of turnover or the number of employees. In addition, the samples were dealing with different number of brands supplying differethe nt number of products per month. Even though there is no balance in the samples chosen in respect of their activities, the survey has evoked a reasonable response from the respondents to meet the objectives of the study.

From the profile, it can be observed that most of the respondent companies employ workers between 11 and 50. It is also observed that 77% of the respondent companies are sole proprietary concerns, while 2 were private limited companies and the remaining organizations (n=a 10) were partnership firms. The constitution of the organizations representing the samples reveals that majority of them are owner managed, which fact validates the findings of the study, as the owners will be able to offer better views on the marketing and internationalization strategies of household appliance brands. Another important feature of the organizations surveyed is that majority of the respondent companies were dealing in more than 15 leading brands. Dealing in more number of brands gives them a clear idea on the marketing and internationalization strategies that brands like Haier need to follow.

This again increases the validity of the findings of the current research. Almost all the respondent organizations were dealing in all or a combination of the consumer electronic and household appliances products. Only two of of the respondents deal exclusively with household appliances. More than 40% of the respondent organizations are large in that they distribute more than 1000 household appliances per month. Six respondent organizations distribute more than 1500 items and the remaining organizations sell less than 500 items per month. The profile of the respondent organizations becomes important to assess the homogeneity of the samples and their representation of the total population. Based on the information on the profile of the respondent organizations, it can be stated that they represent the total population of the dealers and distributors of household appliances. Therefore, no sampling bias will arise in the current research. A table containing information on the profile of the respondent organizations is exhibited as part of this dissertation in Appendix II.

Findings from the Survey

The first question was on the awareness of the respondents about Haier brand of household appliances. The responses are tabulated below.

The responses indicate that almost all the respondents are aware of Haier household appliance products.

The respondents were asked to report whether their organizations deal with Haier products. The following figure represents the responses received from the interviewees.

For the question on the criteria that the customers look for acceptance of household appliances, the respondents to the survey replied that brand image and the price range are the important consideration of the customers for the acceptance of a household appliance. The answers to the questions are presented in the following graph.

The next question sought to know from the respondents the most important factor that a customer looks for in a particular brand, when he/she has chosen the specific brand, which he/she intends to purchase. The answer to this question becomes important to determine the marketing strategy that the brand has to pursue for improving the sales in the foreign market. Depending on the cultural factors affecting the choice of products, the customers may look for certain specific aspects of the product, which he/she intends to purchase and the presence or absence of this quality, will determine the purchase intention of the customer. The respondents were presented with ten options including service availability and warranties and replacements. The respondents were asked to rank the seven options provided in the questionnaire in a scale of 1 to 5 where “1”is the least important factor for the choice of the product within the brand and “5” is the one having the strongest effect on the choice of the product. The responses were given weights based on the ranking the respondents gave and the weighted average was calculated to report the relative position of the attributes on the choice of a product within the chosen brand. The graphic representation of the information is as below:

The respondents were asked to reply on the factors determining the success of a particular brand in making the customers loyal. The respondents were asked to rank the seven options provided in the questionnaire in a scale of 1 to 5 where “1”is the least important factor where the factor may not have any effect and “5” is the one having the strongest effect on building brand loyalty for the product. The responses were given weights based on the ranking the respondents gave and the weighted average was calculated to report the relative position of the attributes to denote the contribution for brand building.

The following figure represents the responses from the survey in this respect.

Through the next question, the respondents were asked to indicate the factor determining the competitive strength of a household appliance product in a particular market. The respondents were asked to rank the eight options provided in the questionnaire in a scale of 1 to 5 where “1” is not important action in their opinion for achieving the strategic objectives of the company and “5” is the one, which is the most important for enhancing the competitive strength of a product. The responses were given weights based on the ranking the respondents gave and the weighted average was calculated to report the relative position of the attributes to denote the action to be taken by the management for achieving the strategic goals of the companies.

On the question of the important factor affecting the penetration of a particular household appliance product in a particular market, the respondents replied lack of comparative functionality and the presence of competitors were the main factors hindering the penetration of a product in a new market. The respondents were given seven options to rank the factors in order of importance according to their opinion. Lack of advertisement and promotion and poor market intake are the other factors identified by the respondents for slow penetration. The answers to this question outline the challenges that a new product has to meet while planning to be launched in a new market. The factors affecting the penetration of a product in a new market are tabulated below.

Table: Factors affecting Growth of Small Manufacturing Businesses in the UK.

While answering the next question, the respondents reported that local manufacturing and distribution is the best entry strategy for a household appliance manufacturer. Some of the respondents have indicated that opening branch sales offices may provide a better base for a foreign firm as an entry strategy. The information provided by the respondents is presented in the above graph.

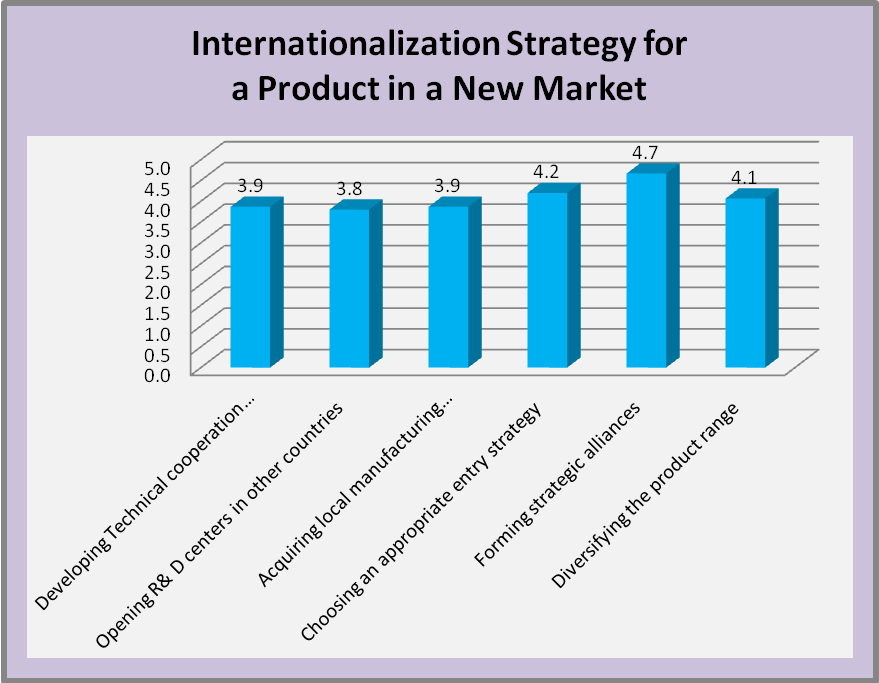

Through the next question, the respondents were asked to indicate their opinion on the best internationalization strategy for a household appliance brand like that of Haier. The responses to the question are represented by the following figure.

Finally, the respondents were asked to state their opinion on certain aspects of Haier products to determine their perceptions on the factor responsible for the success of Haier products in the European market. Six statements were made, which the respondents categorized as below.

This section presented the findings of the survey conducted among the respondent organizations representing small manufacturing organizations operating in the UK. The research instrument of the questionnaire contained questions on the profile of the organizations as well as questions on several aspects of strategic management practices as they are applied to small business organizations. An analysis of the responses to the survey forms part of the next section.

Analysis

The current research was undertaken to examine the internationalization and marketing strategies of Haier Group for entering the European market. In order to achieve the objectives of the study, a quantitative survey was conducted among the dealers/distributors of household appliances. This section analyzes the findings of the survey.

Analysis of the Profile of the Respondents

The respondents to the survey represent the business organizations, which are dealing in different brands of household appliances, are most likely to have knowledge on the marketing and internalization strategies to be adopted by different brands. Since most of the respondent organizations are sole-proprietary concerns, the owners will have personal knowledge on the strategies and therefore can offer better information concerning the marketing strategies of Haier and other brands of household appliances. The fact that the majority of the respondents have been dealing with more number of brands adds to the value of the information provided by the respondents. Owner/managers of the respondent organizations will be having exposed to the different brands of household appliances. Based on their can compare the marketing strategies of differ with ent brands they are dealing and present their views and perceptions of the best strategies that need to be adopted by Haier or another brand for internationalizing their products. In addition, the respondents have been dealing in consumer electronics and several other products apart from household appliances. The respondents would have been exposed to the marketing strategies of these other products and from that experience, they would be able to offer appropriate strategies for the guidance of brands like Haier, so that they can enter into European and other foreign markets.

Analysis of the Findings on Internationalization and Marketing Strategies

The information that 76% of the respondent organization deals with Haier Group products adds to the value of the responses. Based on the responses and the review of the literature it can be stated that Haier has adopted the marketing strategy of establishing its brand as a dependable refrigerator in the domestic market. The first stage of development Haier was characterized by the efforts of the company to explore and accumulate experience in the production of quality products and in the successful building of brands through efficient management. The respondents have indicated brand image as the most important factor that the customer consider for accepting a household appliance product. This is in conformity with the theoretical observation of Hankinson and Cowking (1993), which state that it is essential that an organization has to develop a distinct competitive advantage superior to that of competitors so that it can build a strong brand. The authors also state that this would help the firm to maintain and improve its market share. Rooney (1995) confirmed this view. Haier Group has proved this theoretical observation, as the first marketing strategy of building its brand by producing superior quality products.

For the answers to the question on customer acceptance criteria for a specific brand in household appliances the respondents have indicated that the product should have extensive arrangements f,or after sales service of the products. According to the respondents, the availability of warranties and replacements easily is the second important factor that the customers look for while accepting a specific brand. This is proved by the strategies adopted by Haier for promoting its products in different countries of the world. The analysis of the distribution system of Haier reveals that they had their own sales subsidiaries in many countries for undertaking supplies directly to retailers. At the same time, Haier also had a number of wholesalers. However, the distribution system does not focus on the wholesalers or retailers; but it concentrated on direct business of their own building up a strong distribution system. The company the established a complete network of after-sales service installation to back up the distribution system. This accounted mainly for the success of the brand in many countries. Aaker (1998) is of the opinion that successful brand creators go beyond the point of representing product-attributes. They also create brand personality, emotional beliefs and self-expressive benefits as additional associata ion to brands. Effective after-s,ales service is one of such brand association factors, which Haier understood and performed effectively to make its products a success, whichever market they enter. Tybout and Carpenter (2000) also talk about a number of associations or a combination thereof to promote the brand of a product. The responses of the sample organizations that after-sales service is an important factor affecting the brand building of a product also confirm this point.

When the respondents were asked to indicate the factor determining the competitive strength of a product, a majority of them indicated that offering value for money is the most important factor that determines the competitive strength of a product in a global market scenario. Brands can create value for their products by offering better quality products than the competitors for the price the customers pay for the products. One of the strategies adopted by Haier Group for the promotion of its products in the international markets is to improve the quality of its products. The continuous efforts of the company to improve the quality of its products have helped the company to offer technologically superior products to the customers than its competitors. The technological alliance with the German company of Liebherr and several other technical associations with leading organizations in different parts of the world helped Haier Group to produce world-class products for meeting the changing needs of the customers. The company was able to offer higher value for money to the customers, by combining the strategies of internationalization of technology and product diversification. Cantwell and Piscitello (1999) talk of product diversification as one of the strategies of MNEs to exploit different markets. Product diversification is attempted by MNEs to enhance the value of its product to the customers. Brand image is the next factor influencing the competitive strength of a product, as indicated by the respondents to the survey. This has been proved in the case of Haier, as the company has been successful in many international markets, by establishing its brand image by adopting different marketing strategies.

In the case of any brand manufacturer desirous of internationalizing its products, the strategy it adopts to enter a foreign market is of prime importance. In the case of Haier Group, the company first adopted the strategy of exports to other countries starting with Indonesian markets. In the next stage, the company started entering joint venture arrangements with local partners in the Philippines, Dubai, Iran, Algeria and other countries. The company entered the European mby arket first adopting the strategy of exports and later on using the joint venture strategy. Starting from the year 2006, the company has followed the strategy of establishing its own local manufacturing facilities. “Overall, Haier has so far established three overseas industrial parks (in the United States, Pakistan, and Jordan) and 30 overseas factories” (Duysters et al, 2009). This strategy of Haier Group corresponds with the finding of this research that local marketing and distribution is the best entry strategy for a household appliance product, as indicated by the respondents to the survey. Gereffi and sturgeon (2004) found this phenomenon of shifting their manufacturing operations to developing economies by the majority of consumer product manufacturers. According to Anderson and Forsgren (1996), this practice of establishing local manufacturing facilities has helped the MNEs to avoid the “subsidiary-headquarter” problems, which led to several morale and initiative issues.

Forming strategic alliances, choosing an appropriate entry strategy and diversifying product range are the most important strategies that a firm may adopt to internationalize its products. Haier Group has adopted all these three strategies in different phases of its growth, apart from increasing its R&D efforts to bring continuous improvements in their products. It is seen that Haier Group formed several strategic alliances with different leading organizations around the world starting from its German association to improve its technical capabilities, which was found the most effective strategy for internationalizing its products. Secondly, the company undertook rapid product diversification by entering into the production of a number of new products deviating from the use of its original core competence in producing refrigerators. In the matter of choosing an appropriate entry strategy, Haier Group has been successful in having its own manufacturing in 30 overseas locations. The findings of the survey have proved the marketing and internationalization strategies of Haier Group as the best ones for internationalizing its products. The responses to the various statements made by the questionnaire about Haier products have precisely assessed the position of the products as perceived by the respondents to the survey.

Conclusion and Recommendations

Conclusion

The purpose of the current research was to analyze the marketing and internationalization strategies of Haier Group to enter the European market. By engaging a quantitative survey and a review of the relevant literature, the study analyzed the marketing and internalization strategies of household appliance brands in general. The responses to the survey revealed that choosing an appropriate entry strategy, forming strategic alliances and diversifying the product range are the most appropriate strategies that a firm can adopt to internationalize its products. The study was extended to a theoretical analysis of the concept of branding and its impact on internationalizing household appliance products. A review of the efforts of Haier Group in improving the quality of its products for establishing a successful international brand formed part of this research and the research report carried an elaborate discussion on different marketing and internationalization strategies of Haier Group. The findings of the survey helped achieving the third objective of the study of analyzing the impact of different factors influencing the expansion of household appliance products on a global level. The theoretical review and the findings of the survey answered all the research questions set at the beginning of the research. To this extent, the research has been successful. However, the research suffered from certain limitations.

Limitations

This empirical study suffers from a number of limitations, which need to be taken care of in future research. First, the response rate for the study is too small considering the total population of dealers/distributors of household appliances operating at the research setting. Thus, it can be assumed that only those companies, which have exposure to marketing and internationalization strategies of household manufacturers, may therefore be either small or inflated and in both cases the results of the study suffers a limitation for generalizing the results. Second, the investigation is difficult to compare, because of differences in terms of constitution, sample size, company size and type of brands and products dealt with by them. Since the study is limited to one industry only, it reduces the potential of the study to offer generalizable inferences. It would be interesting to examine whether there are differences in the strategies for different types of products.

Recommendations

Based on the experience of this research, there are several other areas for research identified. For instance, a comparative study of the marketing and internationalization strategies of Haier Group with any other popular brand will increase the knowledge on the topic of study. A quantitative study of the increased sales growth after the company pursued any of the marketing strategies in any one particular setting may be of help in analyzing the impact of the strategies.

References

Aacker, D. A.. Strategic Market Management. New York: John Wiley & Sons, 1998.

Andersson, U., & Forsgren, M. Subsidiary embeddedness and control in the multinational corporation. International Business Review,.5(5): 487–508, 1996.

Beaudry, C. ‘Entry, growth and patenting in industrial clusters: A study of the aerospace industry in the UK’, International Journal of the Economics of Business, 8, 405-436, 2001.

Bongalia Federico & Goldstein Andrea, Strengthening Productive Capacities in Emerging Economies through Internationalization: Evidence from the Appliance Industry, Web.

Burns, N and K Grove. The practice of nursing research: Conduct, critique and utilization (13th ed.). Philadelphia: Saunders, 2005.

Cantwell, John A. and Lucia Piscitello. ‘The emergence of corporate international networks for the accumulation of dispersed technological capabilities’, Management International Review, 3(9), Special Issue 1, 123-147, 1999.

Cavana, R.Y., Delahaye, B.L., and Sekaran, U. Applied Business Research: Qualitative and Quantitative Methods, ISBN 0471341266, 2001.

Creswell, J. Research Design: Quantitative & Qualitative Approaches, Sage Publications, Thousand Oaks, CA, 1994.

Czinkota, M. R., & Ronkainen, I. A. International Marketing 7th Edition. Ohio United States: Thomson Learning, 2004.

Dalrymple, J. D., & parsons, L. J. Basic Marketing Management 2nd Edition. New York: John Wiely & Sons, 2000.

Denzin, N K and Y S Lincoln. Strategies of qualitative inquiry, Thousand Oaks CA: Sage Publications, 1998.

DeWitte, K and J J VanMuijen. “Organizational Culture,” European Journal of Work and Organizational Psychology, 8. (4). 497-502, 1999.

Duysters Geert, Jacob Jojo, Lemmens Charmianne & Hu Jintian, Internationalization and Technological Catching up f Emerging Multinationals: A Case Study of China’s Haier Group, United Nations University Working Paper 052, 2008.